Former Federal Reserve Chair Janet Yellen’s confirmation hearing for U.S. Treasury secretary was held Jan. 19. AP Photo/Jacquelyn Martin

Former Federal Reserve Chair Janet Yellen’s confirmation hearing for U.S. Treasury secretary was held Jan. 19. AP Photo/Jacquelyn Martin

Janet Yellen is poised to be the next U.S. Treasury secretary, and her inbox will require every ounce of her vast experience to pilot the economy through a daunting confluence of challenges. How the U.S. manages the economic recovery from COVID-19, the financial risks from climate change and inequality together will determine the chances of American prosperity over the coming decades.

First, Yellen will need to ensure that economic stimulus packages produce a job-rich recovery from the COVID-19 pandemic.

She can help guide the U.S. to the sweet spot of immediate growth that also puts the country on the path toward a cleaner, more resilient future. This means measures that steer investment and job creation in the sectors of the future, including clean energy, energy efficiency, clean transport and resilient agriculture.

Second, she will have a crucial role in orchestrating a total government approach to climate risk and resilience. That includes working across every department and agency involved in the regulation, policy and management of financial markets and the economy.

Third, COVID-19 has revealed the extent of the nation’s lack of resilience. With climate shocks only expected to intensify, Yellen’s role in the nation’s recovery also means confronting inequality.

Our mission is to restore economic prosperity and financial stability.

— Janet Yellen (@JanetYellen) December 7, 2020

We’ll do that by pursuing an investment agenda to rebuild our infrastructure, create better jobs, advance racial equity, and fight the climate crisis. pic.twitter.com/IDUKBlcFDs

Yellen, a former Federal Reserve chair and professor of economics, is respected by her peers and international financial institutions, and she will be in a position to persuade banks and businesses to take climate change seriously. But there will be no honeymoon.

I have been involved in international sustainable development and climate diplomacy for years as a former World Bank vice president and senior U.N. official, and I see several ways Yellen can use the power of the U.S. Treasury to lay the foundation for real and lasting progress on climate change.

Finding a way to put a price on carbon

The good news is that Yellen has a keen understanding of the issues surrounding climate change and their interplay, and the roles that financial regulators and economic leaders can play.

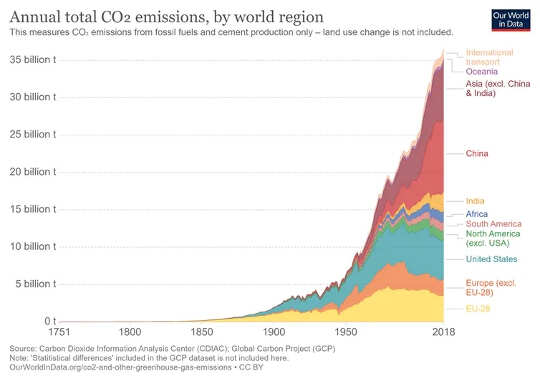

For example, she is sensitive to the need to put a price on carbon pollution to help curb emissions. The cost of that pollution today is borne by the public, from bad air quality to extreme weather and sea level rise. A carbon price, coupled with incentives and standards, will speed up the drive to clean technologies by making polluting expensive for companies and risky for their investors.

Yellen said last year that she could see a way forward with bipartisan support for a carbon tax that charges polluters for their carbon emissions and redistributes the proceeds to Americans in quarterly payments, a move that would help low-income residents in particular as the world shifts to cleaner energy. After years leading the Climate Leadership Coalition, a bipartisan platform advocating for effective carbon pricing, she has the credibility to engineer progress on such a hot-button issue.

Global carbon emissions. Our World in Data, CC BY

Global carbon emissions. Our World in Data, CC BY

More of her views can be seen in the recommendations of a task force Yellen co-chaired in 2020 with Mark Carney, the former head of the Bank of England, for the economic think tank the G30. The task force recommended that to achieve net-zero emissions, all countries need to price carbon appropriately; shift incentives for companies and their executives so sustainability is a priority; and harness markets to speed up the rate of transition away from fossil fuels.

The task force also recommended that countries set up Carbon Councils, independent government bodies that would “supervise and oversee markets to ensure the delivery of real, positive planetary outcomes and dramatically lowered greenhouse gas emissions.

That advice may be redundant with the appointment of Gina McCarthy in the new role of national climate advisor.

Bringing climate risk awareness to the financial system

Yellen has an important role to play and a mechanism already at hand: the Federal Stability Oversight Council. It was created by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act to identify risks to U.S. financial stability and respond to emerging threats. The council is chaired by the Treasury secretary and comprises all major federal financial regulators. This is a place where Yellen can insert climate risk awareness into the U.S. finance’s central nervous system.

In the past few years, other countries’ central banks have both introduced climate-risk stress tests to determine financial institutions’ vulnerability to climate change and imposed rules around exposure to fossil fuels. The U.S. lags, but there is momentum for Yellen and the FSOC to build on.

The Federal Reserve has already identified climate change as a risk to financial stability, and in December, it joined the Network for Greening the Financial System, a global leadership group of central banks and financial regulators.

Using international aid to rebuild soft power

Yellen, whose Senate confirmation hearing went smoothly on Jan. 19, will also be coordinating efforts across the government to most effectively manage U.S. global financial engagement on climate change and other risks.

She has unique reach through international finance. The Treasury Department can influence USAID, which provides aid to countries in need; the Millennium Challenge Corp., which supports economic development to reduce poverty; the Export-Import Bank, which provides financing to boost U.S. exports; the U.S. Trade and Development Agency, which helps connect U.S. companies with infrastructure projects overseas; and the potentially powerful International Development Finance Corp. In the right hands, the tools of the DFC can help channel funding to green and resilient infrastructure in low-income countries.

Financing climate-friendly projects could help the U.S. reclaim both soft power overseas and its international climate leadership. However, support for pandemic recovery and climate resilience cannot mire low- and middle-income countries in more debt. The debt crisis, worsened by COVID-19, demands careful choreography among international financial institutions, European allies, China, central banks and private financiers. And it will need some fresh thinking.

The Treasury secretary’s inbox is daunting in its complexity. There’s a lot riding on Janet Yellen’s shoulders, head and heart.![]()

About The Author

Rachel Kyte, Dean of the Fletcher School, Tufts University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Related Books

Drawdown: The Most Comprehensive Plan Ever Proposed to Reverse Global Warming

by Paul Hawken and Tom Steyer In the face of widespread fear and apathy, an international coalition of researchers, professionals, and scientists have come together to offer a set of realistic and bold solutions to climate change. One hundred techniques and practices are described here—some are well known; some you may have never heard of. They range from clean energy to educating girls in lower-income countries to land use practices that pull carbon out of the air. The solutions exist, are economically viable, and communities throughout the world are currently enacting them with skill and determination. Available On Amazon

In the face of widespread fear and apathy, an international coalition of researchers, professionals, and scientists have come together to offer a set of realistic and bold solutions to climate change. One hundred techniques and practices are described here—some are well known; some you may have never heard of. They range from clean energy to educating girls in lower-income countries to land use practices that pull carbon out of the air. The solutions exist, are economically viable, and communities throughout the world are currently enacting them with skill and determination. Available On Amazon

Designing Climate Solutions: A Policy Guide for Low-Carbon Energy

by Hal Harvey, Robbie Orvis, Jeffrey Rissman With the effects of climate change already upon us, the need to cut global greenhouse gas emissions is nothing less than urgent. It’s a daunting challenge, but the technologies and strategies to meet it exist today. A small set of energy policies, designed and implemented well, can put us on the path to a low carbon future. Energy systems are large and complex, so energy policy must be focused and cost-effective. One-size-fits-all approaches simply won’t get the job done. Policymakers need a clear, comprehensive resource that outlines the energy policies that will have the biggest impact on our climate future, and describes how to design these policies well. Available On Amazon

With the effects of climate change already upon us, the need to cut global greenhouse gas emissions is nothing less than urgent. It’s a daunting challenge, but the technologies and strategies to meet it exist today. A small set of energy policies, designed and implemented well, can put us on the path to a low carbon future. Energy systems are large and complex, so energy policy must be focused and cost-effective. One-size-fits-all approaches simply won’t get the job done. Policymakers need a clear, comprehensive resource that outlines the energy policies that will have the biggest impact on our climate future, and describes how to design these policies well. Available On Amazon

This Changes Everything: Capitalism vs. The Climate

by Naomi Klein In This Changes Everything Naomi Klein argues that climate change isn’t just another issue to be neatly filed between taxes and health care. It’s an alarm that calls us to fix an economic system that is already failing us in many ways. Klein meticulously builds the case for how massively reducing our greenhouse emissions is our best chance to simultaneously reduce gaping inequalities, re-imagine our broken democracies, and rebuild our gutted local economies. She exposes the ideological desperation of the climate-change deniers, the messianic delusions of the would-be geoengineers, and the tragic defeatism of too many mainstream green initiatives. And she demonstrates precisely why the market has not—and cannot—fix the climate crisis but will instead make things worse, with ever more extreme and ecologically damaging extraction methods, accompanied by rampant disaster capitalism. Available On Amazon

In This Changes Everything Naomi Klein argues that climate change isn’t just another issue to be neatly filed between taxes and health care. It’s an alarm that calls us to fix an economic system that is already failing us in many ways. Klein meticulously builds the case for how massively reducing our greenhouse emissions is our best chance to simultaneously reduce gaping inequalities, re-imagine our broken democracies, and rebuild our gutted local economies. She exposes the ideological desperation of the climate-change deniers, the messianic delusions of the would-be geoengineers, and the tragic defeatism of too many mainstream green initiatives. And she demonstrates precisely why the market has not—and cannot—fix the climate crisis but will instead make things worse, with ever more extreme and ecologically damaging extraction methods, accompanied by rampant disaster capitalism. Available On Amazon

From The Publisher:

Purchases on Amazon go to defray the cost of bringing you InnerSelf.comelf.com, MightyNatural.com, and ClimateImpactNews.com at no cost and without advertisers that track your browsing habits. Even if you click on a link but don't buy these selected products, anything else you buy in that same visit on Amazon pays us a small commission. There is no additional cost to you, so please contribute to the effort. You can also use this link to use to Amazon at any time so you can help support our efforts.